Push to change Indiana property taxes to benefit charter schools triggers alarm in IPS

This story was originally published by Chalkbeat. Sign up for their newsletters at ckbe.at/newsletters.

INDIANAPOLIS (WISH) — Republican lawmakers are advancing major changes to the state’s school funding system to benefit charter schools and districts with relatively low property tax values.

The proposed Republican House budget, along with a newly amended GOP Senate bill, would rework Indiana’s property tax system to pump more funding into charters and level what lawmakers say is an unfair playing field for charters and traditional public schools. Lawmakers also might create a dedicated funding stream for charters’ capital expenses that would replace the so-called “$1 law.”

But the proposals have been sharply criticized by Democrats and traditional public school leaders, who argued that the changes would come at the expense of thousands of students in traditional public schools.

The bills channel issues at the heart of a recent dispute over tax revenue in Indianapolis Public Schools. The district withdrew its plan to ask voters for new property taxes on the May ballot, amid criticism from charter school supporters that the draft ballot measure did not provide charters enough money. If the proposals become law, they could change the long-term balance of fiscal power within the state’s public education system.

Together, House Bill 1001 and Senate Bill 391 would do the following to boost funding for charters and school districts with low property values:

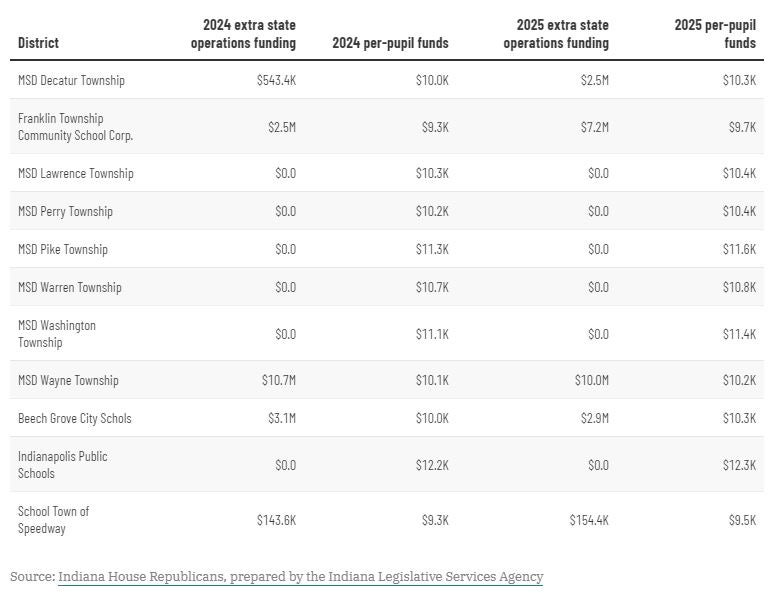

- Provide $1,400 per charter school student from the state in fiscal year 2024 and $1,500 in fiscal year 2025, replacing a state program that provides $1,250 per student to compensate for a lack of property tax revenue.

- Provide $20 million in next year’s budget for charter schools’ capital needs.

- Require school districts in Marion, Lake, St. Joseph, and Vanderburgh counties to share with charter schools any revenues from ballot measures passed to support operating or school safety expenses after June 30, 2023. Virtual charters and adult high school charter schools would not receive such funding. A fiscal analysis says the revenue would be shared “proportionally.”

- Provide state funding for school districts that are unable to raise at least $1,400 per pupil from its operating fund in 2024 and $1,500 in 2025. The funding would supplement existing property taxes to get to those baselines each year.

In addition, the budget bill would require traditional school districts to reduce their maximum tax rate for operation expenses to 40 cents per $100 of net assessed value by 2031.

Unlike Indiana’s traditional public schools, charters generally do not receive property tax revenues. The one exception is for those considered part of Indianapolis Public Schools, which has opted to share some property tax revenue with its affiliated charters.

Nevertheless, Indianapolis charter school leaders have repeatedly said that the gap between funding for traditional school students and charter students is over $7,000 per student.

“What the House is trying to do is trying to look at charters in parity with the other public schools,” Rep. Bob Behning, the Republican leader of the House education committee, told Chalkbeat. “How do we get them closer to parity with the traditional public schools in terms of funding?”

The proposals would mean significant changes for IPS, where there are over 25 charter schools in the district’s Innovation network and just over 30 other independent charters within district boundaries.

Indianapolis Public Schools would lose $30 million over the next three years under the proposals, IPS Superintendent Aleesia Johnson told lawmakers last week at a hearing on Senate Bill 391. That loss would increase to $220 million by 2031, equivalent to about 500 teaching positions, she said.

Johnson testified that it would harm taxpayers “whose schools will see less dollars as a result of the passed House budget, and who ultimately will be asked to take on an even greater tax obligation on behalf of even more schools because of the system that this state has created.”

Most Marion County districts, including IPS, have an operating tax rate of more than 40 cents that officials would need to cut by 2031.

Charter proponents support sharing

Janet McNeal, president of the Herron Classical Schools charter network, said Senate Bill 391 would alleviate costs that its schools currently face.

When Herron High School moved into the Herron School of Art building, the network had to cut expenses “in every way we could” to prepare the building’s interior, McNeal told the House education committee last week. Nearly two decades later, the school is facing millions of dollars worth of badly needed upgrades to its roof and HVAC system.

“We can’t afford it — we just can’t,” she said. “Thus, we are forced to continue patching the roof, which leaks into our classrooms during heavy rains, and continue to make repairs on our HVAC system — and the repairs are, individually, costly.”

But Democrats in the statehouse say charter backers want more money without the responsibility that should come with it.

“We have groups that don’t want the authority of the school board,” Rep. Ed DeLaney told Chalkbeat. “They don’t want to be tied to the district where the property is located, but they want the money.”

Operating tax rate capped

The Republican budget also caps the rate at which school districts may tax property for operating expenses.

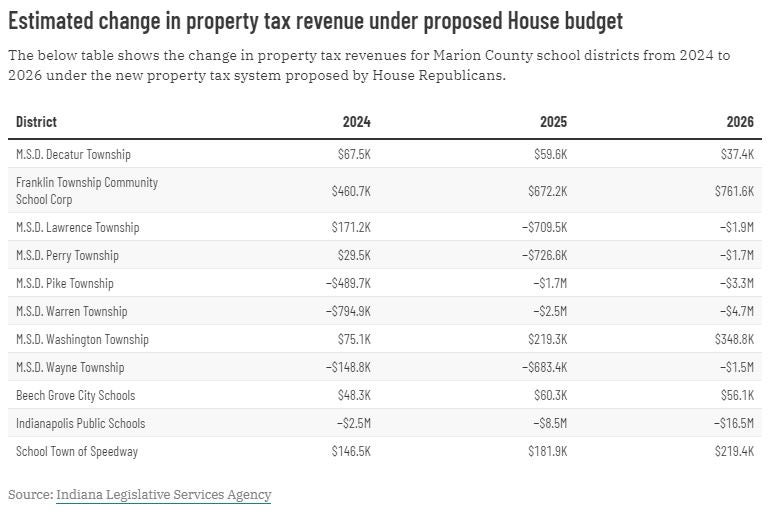

That means four Marion County school districts would collect less than they are currently projected for 2024, according to projections from the Indiana Legislative Services Agency.

Indianapolis Public Schools, for example, would receive $2.5 million less in property tax revenues in 2024, and by 2026, it would receive $16.5 million less.

At the same time, the proposed budget gradually reduces the amount of property tax revenue that is restricted under the state’s property tax cap. This would allow districts to collect more in property taxes each year.

Lawmakers ‘give up’ on $1 law

The Senate bill would also eliminate the state’s $1 law by July 2025.

The law requires school districts to offer “vacant or unused” school buildings to charter schools or state educational institutions for the sale or annual lease price of $1. Enacted in 2005, it was meant to provide charter schools easier access to buildings without the support of property tax revenue.

But the law’s vague wording has led to legal battles between charter schools that want those buildings and traditional school districts that argue they are still in use.

The state attorney general’s office, which is responsible for investigating claims that school districts are not following the $1 law, has ruled against traditional school districts in just one of the nine individual complaints publicly documented so far.

Behning said he does not think the law has worked as anticipated.

“I’m saying I give up,” he said at the House education committee meeting last week. “You are seeing a white flag.”

Instead, the budget bill includes a $20 millionfund that would support capital needs for charter schools.

The proposed House budget is making its way through the Senate. Senate Bill 391 is now in the House Ways and Means Committee.

Amelia Pak-Harvey covers Indianapolis and Marion County schools for Chalkbeat Indiana. Contact Amelia at apak-harvey@chalkbeat.org.

Chalkbeat is a nonprofit news organization covering public education.